Hartland-Peel

Africa Equity Research

Sub-Sahara Africa stock markets have offered outstanding rewards for investors as governments implement market reforms, relax foreign investment restrictions and promote the private sector.

Expertise and Professional Assignments

About Hartland-Peel

Stock Markets

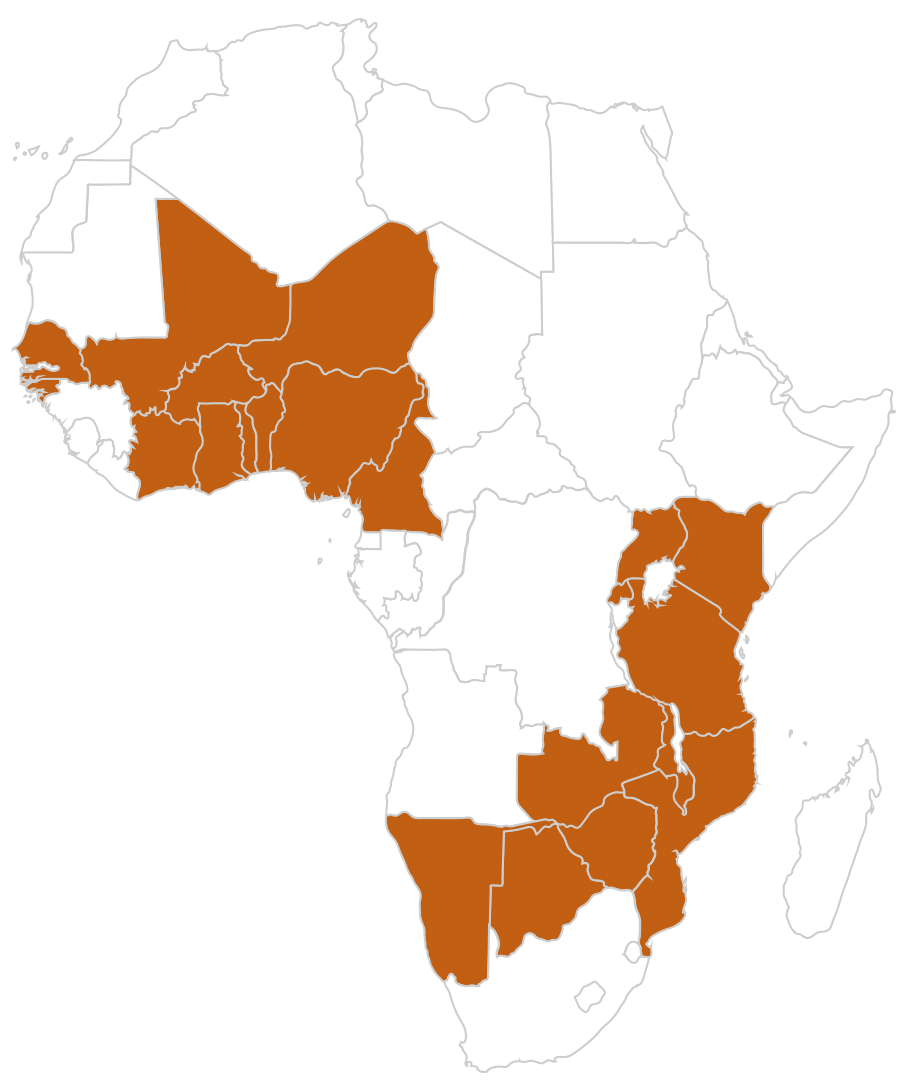

Sub-Saharan Africa

Sub-Sahara Africa stock markets have offered outstanding rewards for investors as governments implement market reforms, relax foreign investment restrictions and promote the private sector.

Sub-Saharan nations have restructured their economies and are well-positioned to profit from the next stage of globalisation.

Sub-Sahara Africa stock markets ex-South Africa:

Stock Markets Data Available

| DATA AVAILABLE | CONTENT | FREQUENCY |

|---|---|---|

Regional stock market indices:

|

|

|

| Market performance year to date and for the most recent month for all countries listed above |

|

|

| Stock market summaries for the principal companies for all countries listed above (90% of market capitalisation covered) |

|

|

| Stock market and country macro-economic view from 1990 for all countries listed above |

|

|

Companies

Company Data Available

| DATA AVAILABLE | CONTENT | FREQUENCY |

|---|---|---|

| Top 30 companies |

|

|

| Top 30 company reviews |

|

|

| Top 30 company financial data |

|

|

Sectors

Sector Data Available

| DATA AVAILABLE | CONTENT |

|---|---|

| Individual sector information |

|